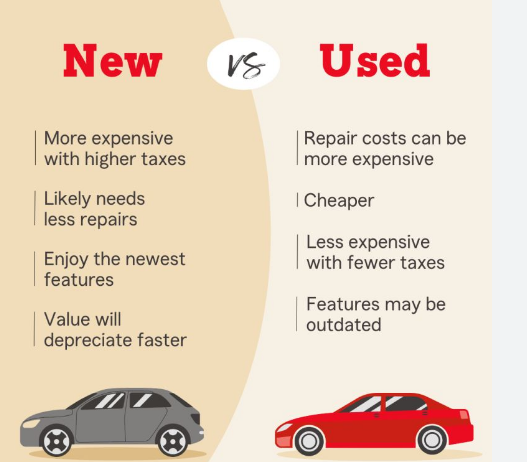

When it comes to buying a car, one of the biggest decisions you’ll face is whether to purchase a new car or a used car. While both options come with their own set of advantages and disadvantages, understanding the financial implications is crucial to making an informed choice. One of the key considerations in this decision is whether to finance the car, and how that financing compares between new and used vehicles.

In this article, we’ll explore the pros and cons of financing a used car versus a new car to help you decide which option might be best for you.

Pros of Financing a New Car

- Lower Maintenance Costs One of the biggest advantages of buying a new car is that it will typically require fewer repairs in the first few years. New cars come with warranties that cover most of the major repairs, so you can expect fewer out-of-pocket costs. This can save you money in the long run, especially when you factor in potential maintenance expenses for a used car, which may need more repairs as it ages.

- Latest Technology and Features New cars come equipped with the latest technology, safety features, and fuel efficiency improvements. If you’re interested in having advanced features like lane-keeping assist, adaptive cruise control, or a modern infotainment system, a new car is the way to go. This can be particularly appealing for those who prioritize innovation and comfort.

- Better Financing Options New cars generally come with better financing options compared to used cars. Automakers and dealerships often offer promotional financing deals, such as 0% APR for qualified buyers or other low-interest financing incentives. This can save you a significant amount of money over the life of the loan compared to used car financing, where interest rates are typically higher.

- Full Warranty Coverage New cars come with manufacturer warranties, typically ranging from 3 to 5 years or longer. This coverage often includes bumper-to-bumper protection as well as powertrain coverage, giving you peace of mind knowing that most major repairs will be covered for several years. In contrast, used cars may have limited or no warranty coverage left, which could result in unexpected repair costs.

- Higher Resale Value While new cars depreciate quickly, they still retain a significant amount of value for the first few years. If you plan to sell or trade in the vehicle in the near future, a new car may hold more value than a used one, especially if it is a popular make and model.

Cons of Financing a New Car

- Higher Purchase Price One of the most obvious downsides of financing a new car is the higher upfront cost. New cars are more expensive than used cars, and that means a larger loan amount, higher monthly payments, and more interest over the life of the loan. This could strain your budget and affect your ability to afford other expenses or save for the future.

- Depreciation New cars begin to lose value as soon as they are driven off the lot. In fact, a new car can lose up to 20% of its value within the first year and up to 60% or more over the first five years. This means that if you decide to sell the car later on, you may not recoup as much of the initial investment as you would like.

- Higher Insurance Premiums Because new cars are worth more, insurance premiums tend to be higher than for used cars. If you finance a new car, you’ll likely face higher insurance costs, which can add up significantly over time. You’ll need to budget for this increased expense when determining if a new car is the right choice for your financial situation.

Pros of Financing a Used Car

- Lower Purchase Price The most significant advantage of financing a used car is the lower upfront cost. Used cars are generally much cheaper than new cars, meaning you’ll need to borrow less money. This results in lower monthly payments, which can make it easier to stay within your budget. If you’re looking for a more affordable option, a used car can give you more value for your money.

- Slower Depreciation Used cars have already undergone the most significant depreciation in value. When you buy a used car, the initial steep depreciation has already occurred, so it will lose value at a much slower rate. This means you are more likely to get a better return on your investment when you sell or trade in the car in the future.

- Lower Insurance Costs Since used cars have a lower market value, they also tend to have lower insurance premiums. Financing a used car can help you save money on car insurance, especially if you opt for a vehicle that is several years old.

- More Car for Your Money With the money saved by purchasing a used car, you may be able to afford a higher-end model or a car with more features than you would if you were buying a new car. For example, you could finance a used luxury car for the same cost as a new, entry-level vehicle, giving you access to premium features, quality, and performance.

Cons of Financing a Used Car

- Higher Interest Rates One of the main downsides of financing a used car is that the interest rates tend to be higher than those for new car loans. Lenders consider used cars to be riskier because they have a shorter lifespan and may require more repairs. As a result, interest rates for used cars are typically higher, which means you could end up paying more in interest over the life of the loan.

- Limited Warranty Coverage Most used cars, especially those that are several years old, are no longer covered by a manufacturer’s warranty. If you buy a used car, you may have to pay for repairs out of pocket or purchase an extended warranty, which can add to the overall cost of the vehicle. While some dealerships offer certified pre-owned (CPO) vehicles with limited warranties, these options are typically more expensive than buying a non-certified used car.

- Potential for Hidden Problems Used cars, particularly those that are older or have higher mileage, may come with hidden mechanical or electrical issues. Even if the car has been inspected, there’s still a risk that something could go wrong after the purchase. This is why it’s essential to have a trusted mechanic inspect the car before buying. If you don’t, you could face costly repairs soon after the purchase.

- Limited Selection When buying a used car, your options are more limited. You may not be able to find the exact make, model, color, and features you want, and you might need to compromise on certain preferences. In contrast, when buying a new car, you can customize the vehicle to your liking, including specific features, trim levels, and even color choices.

Which Option is Right for You?

Deciding whether to finance a used car or a new car depends on your budget, needs, and priorities. If you value having a brand-new vehicle with the latest technology and features, and you’re prepared to handle the higher costs associated with it, financing a new car may be the right choice for you. On the other hand, if you’re looking to save money upfront, avoid rapid depreciation, and pay lower insurance premiums, financing a used car could be a better option.

Key Considerations:

- Budget: Can you afford the higher monthly payments for a new car, or would a used car fit better within your budget?

- Long-Term Costs: Consider the total cost of ownership, including interest rates, insurance, and potential repairs.

- Reliability: Do you want a car that will likely require fewer repairs, or are you comfortable with the possibility of dealing with maintenance issues in a used car?

Ultimately, the best choice comes down to what makes the most financial sense for you based on your personal circumstances. Whatever decision you make, be sure to shop around for financing options and carefully consider the long-term financial implications of your purchase.

Leave a Reply