Natural disasters, from hurricanes and earthquakes to wildfires and floods, can cause devastating damage to homes and properties. While it’s impossible to predict when or where these disasters will strike, homeowners can take steps to protect their properties from the financial impact of such events. One of the most effective ways to safeguard your home is through home insurance.

Homeowners insurance provides financial protection in the event of damage to your home, and this can extend to natural disasters, depending on your policy and the type of coverage you have. Understanding how home insurance protects your property from natural disasters can help you make informed decisions about the right coverage for your needs.

In this article, we’ll explore how home insurance can protect your home from natural disasters, the types of coverage that may be included, and how to ensure you’re adequately prepared.

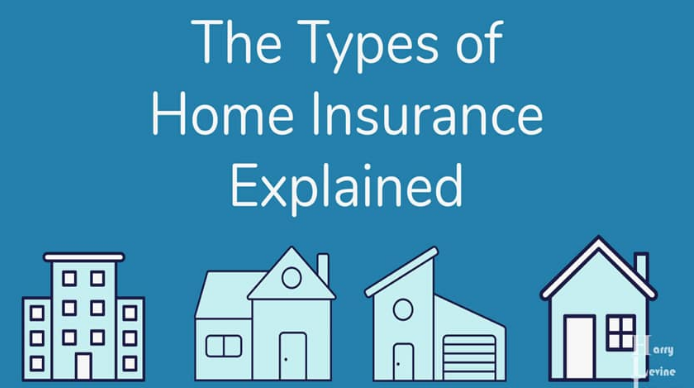

Types of Natural Disasters Covered by Home Insurance

Home insurance policies typically cover damage caused by a wide variety of natural disasters. However, it’s important to understand that coverage can vary depending on the type of policy and the disaster. Here’s a breakdown of some common natural disasters and the coverage provided by standard home insurance:

1. Fire

Fires can be caused by a variety of factors, including lightning strikes, wildfires, or accidents. Most standard home insurance policies offer coverage for fire damage, including both damage to the structure of the home and personal belongings inside.

- Dwelling Coverage: This part of your policy will pay for the repairs to the structure of your home if it’s damaged by fire. It includes walls, roofing, and built-in features like kitchen cabinets.

- Personal Property Coverage: This covers the cost of replacing personal belongings such as furniture, electronics, and clothing damaged or destroyed by fire.

2. Hail and Windstorms

Windstorms and hail can cause extensive damage to your home, especially if you live in an area prone to tornadoes, hurricanes, or severe storms. Standard home insurance policies usually provide coverage for wind and hail damage.

- Roof Damage: Windstorms and hail can severely damage roofs, windows, and doors. Home insurance will typically cover the repair or replacement of these features.

- Additional Living Expenses: If a severe storm leaves your home uninhabitable, your policy’s loss of use coverage can help pay for temporary living expenses, such as hotel bills or renting a place to stay.

3. Lightning Strikes

Lightning strikes can cause fires or damage electrical systems within the home. If lightning strikes your home and causes fire or electrical damage, your homeowners insurance should cover repairs or replacement, including damage to appliances or wiring.

- Structural Repair: Lightning that causes fire damage to your home’s structure will be covered by dwelling coverage.

- Electrical Appliances and Electronics: If a lightning strike damages electronics or electrical equipment, personal property coverage can help you replace them.

4. Tornadoes and Hurricanes

In areas prone to tornadoes and hurricanes, home insurance typically covers wind and storm damage. However, there may be limitations depending on the severity of the storm and whether a separate rider is needed for specific events.

- Wind Damage: Tornadoes and hurricanes can cause extensive wind damage to roofs, windows, and siding. Homeowners insurance usually covers this under windstorm provisions.

- Flood Damage: Flooding caused by hurricanes is typically not covered under standard home insurance policies. Separate flood insurance is necessary to protect against flood-related damages.

5. Earthquakes

Earthquakes are generally excluded from standard home insurance policies. However, in areas with high seismic activity, homeowners can purchase additional earthquake insurance to protect against damage caused by seismic events.

- Foundation and Structural Damage: Earthquake insurance helps cover the costs of repairing damage to the foundation or structure of your home caused by tremors.

- Personal Property: Earthquake damage to personal property may also be covered under earthquake-specific policies.

6. Floods

Floods are one of the most common natural disasters, but most standard home insurance policies exclude flood damage. Homeowners in flood-prone areas need to purchase separate flood insurance through the National Flood Insurance Program (NFIP) or through private insurance companies.

- Property Damage: Flood insurance will cover damage caused by rising water, including structural damage, personal property loss, and the cost of cleaning up after a flood.

7. Wildfires

For homeowners in areas susceptible to wildfires, it’s important to have adequate coverage in place. Wildfire insurance is typically included in standard homeowners policies, but there may be certain exclusions or limits.

- Property Damage: Wildfires can cause total destruction of homes. Home insurance will generally cover repairs or rebuilding costs, but homeowners may need to take steps to ensure that their policy limits reflect the true cost of replacing their property.

- Additional Living Expenses: If a wildfire forces you to temporarily evacuate, your loss of use coverage will help cover living expenses while your home is being repaired or rebuilt.

How Home Insurance Protects Your Property from Natural Disasters

Home insurance is designed to provide financial protection from various perils, including natural disasters. Here’s how home insurance works to protect your property from these events:

1. Dwelling Coverage

As mentioned earlier, dwelling coverage is the part of your homeowners insurance that pays to repair or rebuild the structure of your home if it’s damaged by a covered peril. This includes damage from fires, windstorms, hail, and certain other natural disasters.

- Rebuilding and Repair: After a natural disaster, your dwelling coverage helps pay for the cost of rebuilding or repairing the structure of your home. This may include labor, materials, and permits required for reconstruction.

2. Personal Property Coverage

If your personal belongings are damaged or destroyed in a natural disaster, personal property coverage will help you replace them. This coverage includes items such as clothing, electronics, furniture, and appliances.

- Replacement Value: Many homeowners policies offer the option for replacement cost coverage, which helps replace damaged items with new versions, rather than providing a cash value based on depreciation.

3. Loss of Use Coverage

If your home is rendered uninhabitable due to a natural disaster, loss of use coverage can help pay for temporary housing and other living expenses while repairs are being made. This can include the cost of a hotel stay, meals, and transportation.

- Financial Assistance: If you’re displaced from your home due to a natural disaster, this coverage ensures that you don’t face financial hardship while waiting for your home to be repaired or rebuilt.

4. Liability Protection

Natural disasters can sometimes cause injuries on your property. For instance, falling debris, such as branches or parts of your roof, can injure visitors or neighbors. Liability protection within your homeowners insurance policy covers the cost of medical expenses or legal fees if you’re found responsible for injuries or damages.

- Legal Costs: In the event of a lawsuit resulting from an injury or damage caused by a disaster, liability coverage will help pay for legal defense and potential settlements or judgments.

Additional Coverage for Natural Disasters

While standard homeowners insurance policies offer coverage for many types of natural disasters, there are certain events that may require additional coverage. Here are some types of additional coverage to consider:

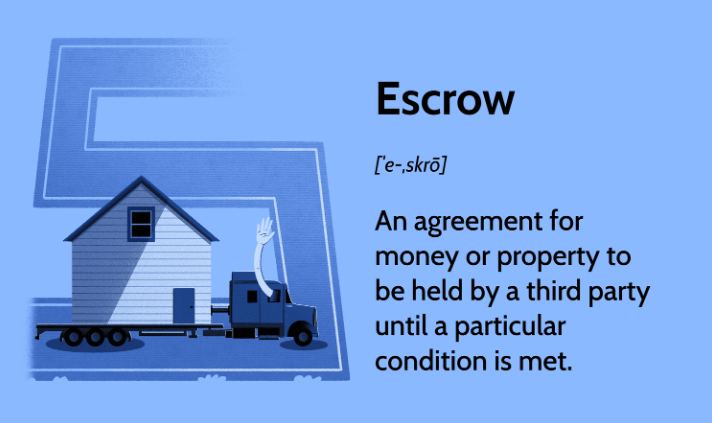

1. Flood Insurance

As flooding is typically not covered by standard home insurance policies, homeowners in flood-prone areas should consider purchasing separate flood insurance.

2. Earthquake Insurance

For homes in earthquake-prone regions, purchasing earthquake insurance is essential to cover damages caused by seismic activity.

3. Hurricane Coverage

In hurricane-prone areas, homeowners may need additional coverage to protect against damage from hurricanes, such as wind and water damage.

4. Wildfire Coverage

In areas susceptible to wildfires, homeowners should ensure their policy includes adequate wildfire coverage to protect their homes from fire damage.

How to Ensure Your Home Is Fully Protected

To ensure that your home is fully protected from natural disasters, consider the following steps:

- Review Your Policy: Regularly review your homeowners insurance policy to make sure it provides adequate coverage for natural disasters common in your area.

- Purchase Additional Coverage: Depending on your location, you may need to purchase separate policies for floods, earthquakes, or wildfires.

- Increase Your Coverage Limits: If the value of your home or personal property increases over time, ensure that your coverage limits are adjusted accordingly to prevent being underinsured.

Conclusion

Homeowners insurance plays a crucial role in protecting your property from the financial consequences of natural disasters. From covering the cost of repairs to providing temporary living expenses, it ensures that you are not left financially vulnerable after a disaster. Understanding the types of natural disasters covered by your policy and purchasing additional coverage when necessary can help safeguard your home and give you peace of mind. Always review your insurance coverage regularly to ensure that it meets your needs and adequately protects you in the event of a disaster.